Table of Contents

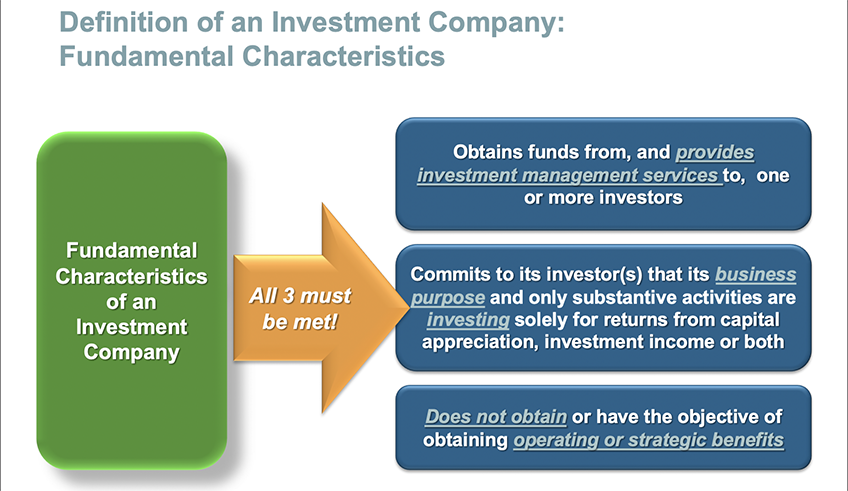

Financial establishment An investment company is a monetary establishment mostly participated in holding, taking care of and investing protections. These companies in the USA are regulated by the United State Securities and Exchange Payment and should be registered under the Investment Firm Act of 1940. Investment firm invest cash in behalf of their customers who, in return, share in the profits and losses.

Investment firm do not include broker agent firms, insurance business, or financial institutions. In USA safety and securities regulation, there go to the very least five types of investment firm: In basic, each of these financial investment business need to register under the Stocks Act of 1933 and the Investment Firm Act of 1940. A 4th and lesser-known type of investment firm under the Investment Business Act of 1940 is a Face-Amount Certificate Company.

A significant sort of company not covered under the Investment Firm Act 1940 is private investment firm, which are merely private companies that make financial investments in supplies or bonds, however are limited to under 250 capitalists and are not regulated by the SEC. These funds are usually made up of very well-off capitalists.

Managed funds normally have constraints on the types and quantities of financial investments the fund manager can make. The majority of investment business are shared funds, both in terms of number of funds and assets under administration.

Investment Management Companies around San Antonio, Texas

The first financial investment depends on were developed in Europe in the late 1700s by a Dutch investor who wished to enable little financiers to merge their funds and diversify. This is where the concept of investment firm come from, as stated by K. Geert Rouwenhorst. In the 1800s in England, "financial investment merging" emerged with trusts that looked like contemporary mutual fund in structure.

New securities laws in the 1930s like the 1933 Stocks Act restored financier confidence.

United State Stocks and Exchange Commission (SEC).

Investment Firms

Lemke, Lins and Smith, Policy of Financial Investment Companies, 4.01 (Matthew Bender, 2016 ed.). Chaudhry, Sayan; Kulkarni, Chinmay (2021-06-28). "Style Patterns of Investing Applications and Their Impacts on Investing Behaviors". ACM. pp. 777788. doi:10.1145/ 3461778.3462008. ISBN 978-1-4503-8476-6. "Financial investment Clubs and the SEC",, Modified January 16, 2013. (PDF). Financial Investment Company Institute. 2023.

In retail financial investment funds, thousands of investors may be involved using middlemans, and they may have little or no control of the fund's activities or knowledge regarding the identifications of other investors. The potential variety of investors in a private mutual fund is commonly smaller sized than retail funds. Personal investment funds have a tendency to target high-net-worth people, consisting of politically exposed persons, and fund supervisors might have a close relationship with their client financiers.

Passive funds have been growing in their market share, and in some territories they hold a considerable section of ownership in publicly traded business. There are numerous different classifications for mutual fund. Some are closed-end, suggesting they have a fixed number of shares or funding, whilst others are open-end, indicating they can grow right into unlimited shares or funding.

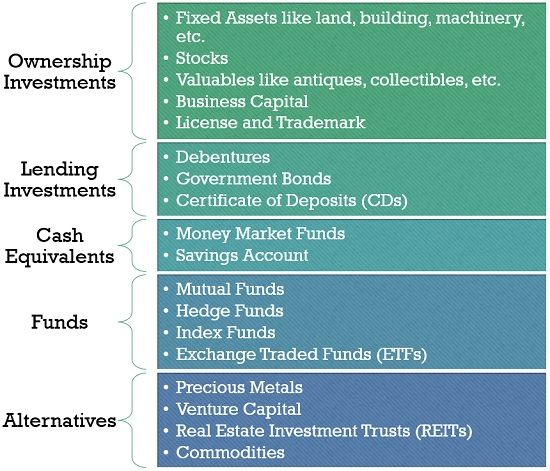

The rates, risk, and terms of derivatives are based on an underlying property, and they allow capitalists to hedge a position, increase leverage, or guess on a property's change in worth. For example, a financier could have both a stock and a choice on the exact same supply that permits them to offer it at an established price; consequently, if the supply's cost drops, the alternative still preserves worth, lowering the investor's losses.

Whilst taken into consideration, offered the emphasis of this rundown on the robot of business lorries, a full therapy of the advantageous ownership of properties is outside its range. A financial investment fund offers as an avenue to benefit from several properties being held as investments. Capitalists can be people, corporate vehicles, or institutions, and there are typically a variety of intermediaries between the capitalist and mutual fund along with between the financial investment fund and the underlying financial possessions, specifically if the fund's systems are exchange-traded (Box 1).

Investment Firms

Depending upon its lawful type and framework, the individuals exercising control of a financial investment fund itself can differ from the people that own and gain from the underlying properties being held by the fund at any type of given point, either straight or indirectly. Both retail and personal investment funds typically have fund managers or consultants that make investment choices for the fund, choosing safeties that line up with the fund's purposes and run the risk of tolerance.

and serve as intermediaries in between capitalists and the fund, facilitating the buying and marketing of fund shares. They connect capitalists with the fund's shares and execute trades on their behalf. take care of the enrollment and transfer of fund shares, maintaining a record of shareholders, refining possession modifications, and providing proxy products for investor meetings.

Navigation

Latest Posts

Investment Company around San Antonio, Texas

Bathroom Remodeler

Bathroom Remodeling Companies